Sometimes, despite your best efforts to manage your finances, life throws you a curveball that you may not be prepared to deal with. When that happens, you may need financing as quickly as possible. Luckily, there are many options to choose from, including several online loans. Here are four situations where you may need money in a rush:

1. Your vehicle needs repairing

As many vehicle owners know, car breakdowns can be unexpected. Whether your car needs a minor fix or a major repair, this may not be an issue you can ignore. You may have to get your vehicle serviced, which can cost several hundred dollars or more to fix. In this situation, financial tools like online installment loans can come in handy. These loans from advanceamerica.net can help you get the funds you need quickly to cover this cost.

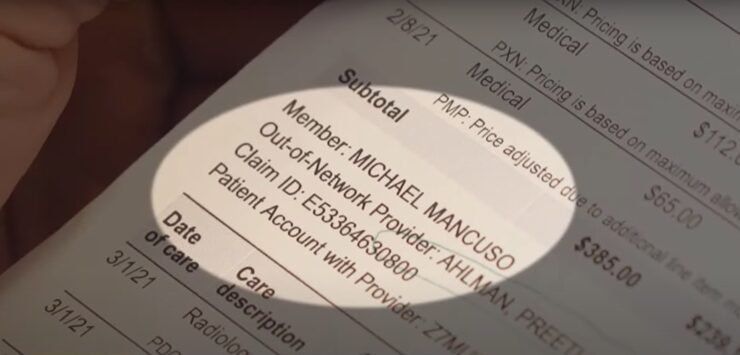

2. An unexpected bill arrives

Although many regular household expenses are generally somewhat consistent, you may receive a bill that’s higher than you were anticipating. For instance, if the energy company decides to raise its rates for electricity and gas, then it will cost more to heat and operate your home over the winter than it did last year.

If you find yourself short on funds, a line of credit can help. This online flexible loan can give you access to money as needed. Better yet, you can pay back what you owe over time.

3. Prices change without notice

In 2022, inflation reached record highs, meaning consumers saw the cost of many items change. From the price of eggs to a gallon of gas, regular weekly purchases became more expensive.

For those who need help covering day-to-day expenses, a payday loan is a great option. This type of online loan can give you a few hundred dollars to hold you over until your next paycheck arrives.

4. Your rent or mortgage payment is due

If your rent or mortgage payment is coming up and you’re short on funds, this is a sign you should look to fast cash loan options for help. In this situation, a title loan could help you get money the same day you apply to cover housing costs. This type of secured loan lets car owners use their vehicles as collateral. If approved, you can keep driving your car as you repay what you owe.

Short-Term Loans

Short-term loans can provide you with a way to cover unexpected expenses or bridge the gap between your income and expenses. These loans typically have higher interest rates than traditional loan products, but their intended use is for emergency financial needs. Many lenders are available to provide you with credit, either in the form of unsecured or secured lending, with quick turnarounds and fast access to funds.

Unsecured short-term loans are suitable for situations when you don’t have collateral or don’t wish to use it. These generally come with a higher interest rate due to their lack of security for the lender. Secured credits are better suited for borrowers who have collateral, such as a vehicle or property, which can be used as a guarantee against defaulting on their short-term loan obligations.

The main benefits include:

- Accessibility: Since they involve fewer requirements than traditional loan products, they tend to be more accessible than longer-term lending solutions;

- Fast turnaround: With more streamlined processes and less paperwork needed, most lenders will offer timely decisions and quick access to funds;

- Ease of repayment: With shorter repayment terms on short-term lenings, there’s less burden on borrowers as they can repay what they owe quicker; and

- Convenience: You can apply online from home without having to visit the lender’s premises.

Credit Cards

Credit cards can be a useful tool for quickly accessing funds when necessary. Depending on the type of credit card you have, you may access cash advances which are loans against the credit line that come with higher interest rates and fees. Before taking out a cash advance you should read your terms and conditions to make sure your plan allows it and understand all of the fees associated with it.

In addition, some credit cards offer an overdraft protection feature that is usually set up as an automatic loan from the issuer in case you spend more than what is available in your account. It is important to check whether these safeguards come with interest rates and fees, as they will cost more than a traditional loan—although if used correctly, they may be less expensive than other forms of short-term financing.

Personal Loans

A personal loan is an unsecured loan for a fixed amount of money you borrow from a lender. It can provide you with access to funds for a variety of expenses, such as consolidating debt or taking time off from work to go on vacation. Personal loans have become increasingly popular in recent years due to the low-interest rates and flexible repayment terms.

When you apply for a personal loan, the lender will review your credit report and score as well as other forms of information, such as updating your bank statement or providing proof of income. Based on this information, they’ll decide if they want to approve the loan and may consider factors such as your credit history and income level when doing so. If approved, the repayment terms may vary depending on the type of loan you choose and the terms specified in your contract. Common repayment terms range from 6 to 60 months with fixed monthly payments that do not increase over time.

The bottom line

If you find yourself in any one of these situations, know that there are ways of getting the help that you need. Online loans can be a great place to find immediate financial relief when money is tight. From installment loans to a line of credit, you can easily apply with an online loan lender and know within a matter of minutes whether you’ll qualify. This could be a fantastic resource that helps you quickly take care of expenses and get back on your feet.