Bond exchange-traded funds (ETFs) are a popular way to get exposure to the bond market without taking on the risks of owning individual bonds. ETFs are investment vehicles that hold a basket of securities and trade on an exchange like stocks. They provide diversification benefits and can offer investors access to various types of bonds in one easy purchase.

This guide will discuss what bond ETFs are, how they work, and some tips for trading them successfully.

What are bond ETFs?

Bond ETFs are investments that track different kinds of bonds, such as government, corporate, municipal, and foreign. They are structured as index funds, meaning they hold a basket of different bonds to reduce risk. A professional fund manager manages the assets the ETF holds, and the ETF trades on an exchange like stocks.

Bond EFTs are attractive to investors because they offer access to a wide range of bonds without the risk of owning individual bonds. Bond ETFs can also benefit diversification because they hold various bonds in one package.

How do bond ETFs work?

Bond ETFs work similarly to stock ETFs. Investors can buy and sell shares of the ETF just like any other stock. The price of the ETF is determined by its underlying holdings, which means that if one or more of the bonds in the basket goes up, so will the ETF. Conversely, if one or more of the bonds decreases in value, so will the ETF. Bond ETFs also provide diversification benefits because investors don’t have to worry about the performance of one particular bond but can instead rely on the performance of the entire basket.

Bond ETFs are also tax-efficient investments because they are exempt from capital gains taxes until sold. This makes them attractive to long-term investors who want to hold onto their investments for many years without worrying about paying taxes on them.

Risks involved with trading bond ETFs

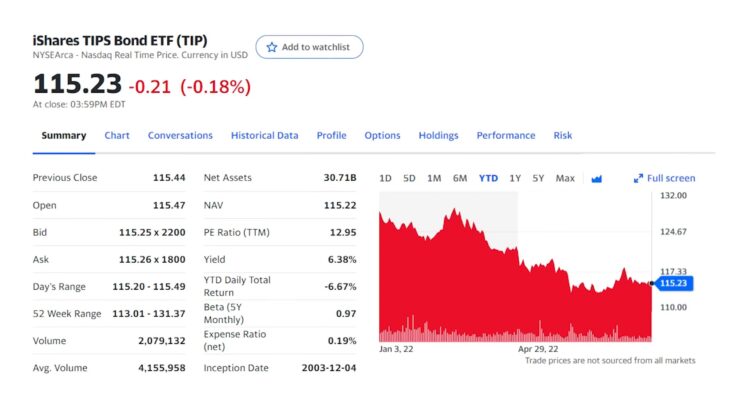

Bond ETFs are generally low-risk investments. However, there are still some risks involved. The most significant risk is that the underlying bonds may decrease in value, which will cause the ETF to also decrease in value. This can happen if interest rates rise or if economic conditions deteriorate. Additionally, the fund manager has discretion over how the assets are managed, which could result in losses for investors if the fund manager needs to make better investment decisions.

Another risk to keep in mind when trading bond ETFs is liquidity risk. Bond ETFs may only sometimes have enough buyers or sellers at any given time, so checking the volume before making any trades is essential. Finally, it’s important to research any particular bond ETF before investing to ensure it is suitable for your investment goals and risk tolerance.

Strategies for bond ETF trading

Bond ETFs are an effective way for investors to diversify their portfolios and gain exposure to a range of fixed-income securities. Bond ETFs are traded like stocks, making them an accessible option for investors seeking to enter the according market. There are various strategies that investors can use when trading ETFs, depending on their investment goals, risk tolerance, and time horizon.

1. Long-term investing

One important thing to consider when investing in bond ETFs is the differences in value vs growth investing. However, regardless of which approach you choose, taking a long-term investment approach is a popular strategy among investors seeking stable, reliable income and capital preservation. By holding an ETF for several years or even decades, investors can benefit from the compounding of interest payments and the potential for capital appreciation. So, if you’re looking for a low-risk investment option with long-term growth potential, bond ETFs might be a good fit for you, regardless of whether you prefer a value or growth investing strategy.

2. Short-term trading

Short-term trading involves buying and selling bond ETFs within a short time frame, often within days or weeks. This strategy requires a more active approach and involves analyzing market trends, interest rate movements, and economic indicators to identify potential opportunities for profit. Short-term trading can be riskier than long-term investing, but it also offers the potential for higher returns.

3. Hedging

Investors can use bond ETFs to hedge against market volatility and mitigate risk. For example, if an investor expects interest rates to rise, they can purchase an accord ETF that invests in short-term accords, which are less sensitive to interest rate changes. This strategy can help offset potential losses in other areas of the portfolio.

4. Diversification

Diversification is a crucial strategy for managing risk and ensuring portfolio stability. Investors can use bond ETFs to diversify their portfolios by investing in a range of fixed-income securities, including government, corporate, and high-yield bonds. Diversification can help mitigate the risk of a single accord issuer defaulting or market volatility.

Tips for trading bond ETFs

When trading bond ETFs, it’s essential to consider a few key factors. First, it’s important to research and understands the different types of bonds that make up the ETF to decide which ones you should invest in. It’s also important to consider the fees associated with the ETF, which can vary depending on the type of fund and the amount you’re investing.

It’s also important to consider the liquidity of the ETF before making any trades. Bond ETFs may not always have enough buyers or sellers at any given time, so it’s important to check the volume before investing.

Finally, watching financial news is essential and ensuring you are aware of any market changes that could affect your bond ETF investments. If you need advice on your trader it may be best to contact an investment specialist such as those connected to Saxo Capital Markets PTE. By contacting a financial advisor and trading through a reputable platform you can help increase your chances of success when trading bond ETFs.

On the whole

Bond ETFs can be a great way to diversify your portfolio and access different types of bonds without purchasing individual ones. However, significant risks are involved with investing in ETFs, including market risk, liquidity risk, and fund manager discretion. It’s essential to research before investing and understand the risks associated with each type of bond ETF to decide which ones are right for you. With careful research and planning, trading bond ETFs can be profitable for investors who want to diversify their portfolios and access bonds cost-effectively.